Solo 401k Contribution Limits 2024 Calculator Nj. 401(k), sometimes called a solo. Corporation or llc taxed as a corporation.

Is my solo 401(k) plan subject to the corporate transparency act (cta)? Of the three, people ask most often about solo 401 (k) plans because:

Your Age (At The End Of The Year In Question)

Solo 401 (k) contribution calculator.

Real Estate And The Solo 401K;

This handy tool will assist you in calculating your annual solo 401k contribution amount.

This Depends On The Level Of Earnings From The Business, As Well As Other Factors.

Images References :

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, Under the 2020 solo 401 (k) contribution rules, a plan participant under the age of 50 can make a maximum employee deferral contribution in the amount of $19,500. The calculator takes about 5 seconds to load.

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), This calculator will calculate the maximum contribution that an individual is able to make to a solo 401 (k). 401(k), sometimes called a solo.

Source: www.abovethecanopy.us

Source: www.abovethecanopy.us

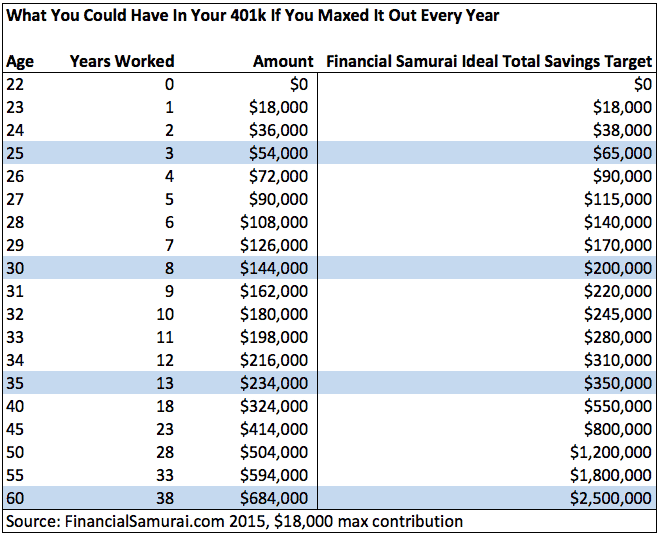

Here's How to Calculate Solo 401(k) Contribution Limits, The maximum percentage contribution to a 401 (k) is 100% of your compensation. For 2024, the limit is $23,000 for those under 50, and $30,500 for those over 50.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401(k) Contribution Limit For 2021, The amount you’re allowed to contribute to an ira in 2023 is puny: Save on taxes and build for a bigger retirment!

Source: zaharawleese.pages.dev

Source: zaharawleese.pages.dev

Max 401k Contribution 2024 Calculator Reggi Charisse, What does it all mean? The combined result is a retirement savings plan you can’t afford to pass up.

Source: millennialmoneyman.com

Source: millennialmoneyman.com

Solo 401k Contribution Limits for 2022 and 2024, Here are some limitations to keep in mind: Roth vs traditional contribution calculator;

Source: www.youtube.com

Source: www.youtube.com

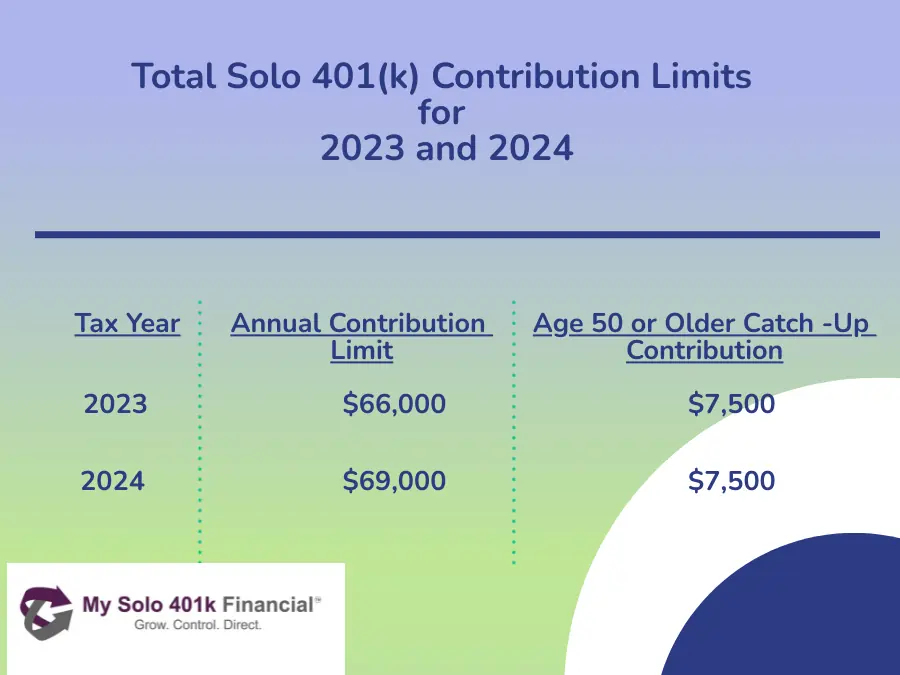

2024 Solo 401(k) Maximum Contribution Limits YouTube, So if your spouse is earning money from your small business, they can also contribute up to the same amount into the solo 401k. Your limit is either 100% of your compensation or $66,000, whichever is lower.

Source: sharylwcalli.pages.dev

Source: sharylwcalli.pages.dev

Solo 401k Roth Contribution Limits 2024 Lani Shanta, Real estate and the solo 401k; For 2024, you can contribute up to $69,000 to your solo 401 (k), or $76,500 if you're 50 or older.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, Solo 401 (k) contribution limits. Your income may fluctuate, and this.

Source: www.mysolo401k.net

Source: www.mysolo401k.net

TotalSolo401kContributionLimitsfor2023and2024 My Solo 401k, In 2023, the maximum you can contribute is $22,500 as the employee plus an additional 25% of earned income as the employer. Combined employee and employer contributions cannot exceed $66,000 or $73,500 for those who are age 50 or older.

For 2024, You Can Contribute Up To $69,000 To Your Solo 401 (K), Or $76,500 If You're 50 Or Older.

Limitations of solo 401(k) contribution calculation accuracy.

This Depends On The Level Of Earnings From The Business, As Well As Other Factors.

Employees can contribute up to $23,000 to their 401 (k) plan for 2024 vs.